How to Approach Tight Ends in Best Ball

Yearly, fantasy football offers new wrinkles with players in different situations and updated associated costs. This year has seen a massive shift in the tight end market. Accordingly, plenty of people increasingly lean into “elite” tight ends at cost. Numerous videos, articles, and posts have been dedicated to this point. There has been pushback and little market movement in the meantime.

Tight End is likely the position with the most potential upheaval because the pool is limited, the scheme plays a major role in performance, and breakouts are less predictable than other positions. While data can guide us on what to expect and target, tight end requires the most massaging to forecast the future accurately.

Historical Performance

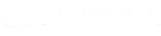

Given the limited and less predictable nature, trends fail to persist across time in the data. The following chart is broken down to show how each draft capital percentile performed when rostering the given amount of tight ends for that row. The values are advance rates shown in decimal notation.

High-end or elite tight end performed extremely well for a couple of years but failed to meet expectations the other two years. Additionally, coming close to elite but not quite meeting that threshold has generally led to wanting results. The best way to qualify as a top spender at tight end has been to take Travis Kelce. Spending as much draft capital as Kelce has gone for without taking him has been difficult. The mid to late-round draft capital cannot equate to the draft capital of the first couple of rounds. A fixture of the first and second rounds, a pick on Kelce has been worth about two later high-end tight ends. Of course, Mark Andrews has also played into this, but Kelce has been the most surefire way to have bucket four tight end spend.

Behind hitting on a top-of-the-line option, taking three later tight ends and falling into one of the first two buckets looks most appealing. Many more combinations of players make up these aggregations, so performing well above the expectation of ~0.166 is very notable. Some appear to hail last year’s late tight ends as mana from heaven that justified the approach. While some big hits came late, this should not be overstated. There have been late-round breakouts in multiple years.

Additionally, considering Sam LaPorta or Dalton Kincaid a late tight end is a bit hard to wrangle. Both these players went at or before the end of the 11th round, which is not quite the free cost of Trey McBride. Outcomes like LaPorta, Kincaid, and McBride are uncommon. Even these high-end outcomes did not move the needle as much as you might think. Aiming for snaps and touchdown upside can help formulate decent upside late in the draft.

I’ll get more into individual tight ends later, but the tables show low to middle spending has performed at or above average. This statement is more true when looking at three tight end builds. If you are not getting a high-end option, I recommend going for three. Taking two later TE1s or talent being bereft at the end can alter this decision.

McBride was a fantastic pick last year, based on results. His ascension in weekly projections failed to manifest into massive spike performances. While he should vault up rankings, do not pretend his performance last year levies late low tight end bucket performance. McBride scored more than 10 points five times last season. Two of those games were after the fantasy regular season.

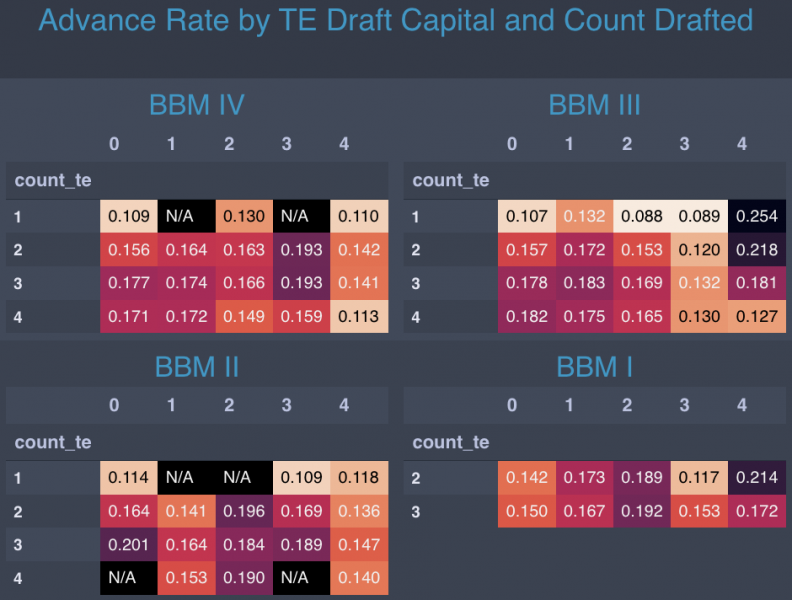

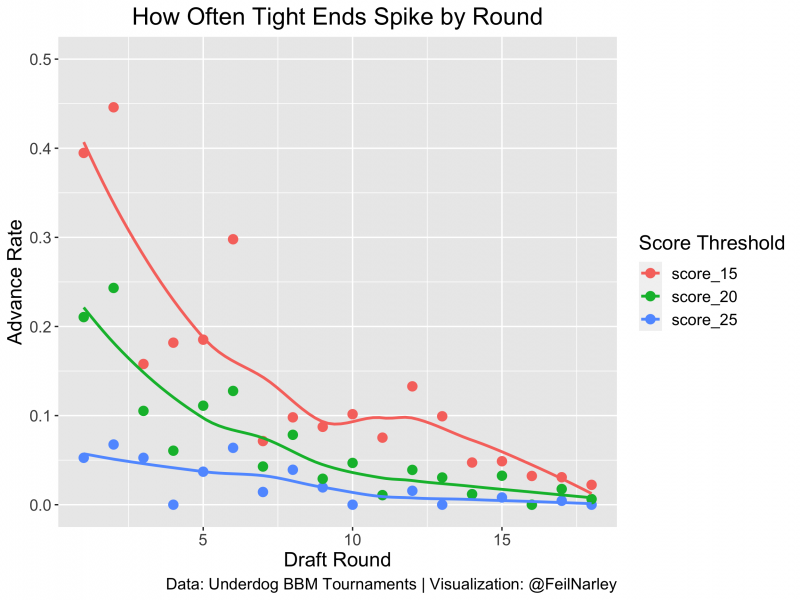

The chart below shows the advance rate for two and three tight end teams. Four tight end teams are viable when taking your first tight end very late. One tight end builds can perform well, as shown in the table above, but I would never do one. The restrictions one tight end builds puts on your team from the limit of roster combinations, bye week sacrifices, and playoff leverage all work against you.

Spike Weeks

Spike week potential is a primary reason people have touted “elite” tight-end builds. Which tight ends, if any, qualify as “elite” became the biggest lightning rod around for a hot moment. To be fair to this nitpicking issue, terminology can differ from place to place, lead to different conclusions, and cause confusion. While ideally, we could avoid binary indicators, assembling groups and aggregating makes analysis easier to do and digest.

Hayden Winks has vocally advocated against calling some of this year’s crop “elite”. I agree with his characterizations but coming up with sticky alternatives is difficult. Data from when Travis Kelce was a first-round pick, Mark Andrews was a second, and George Kittle was a third should not justify the prices of fifth-round and sixth-round tight ends. Unless the underlying numbers are very similar, the market has spoken and those player seasons are too different to use as comps. While this is not extremely important at the moment, it should be noted when evaluating the validity of other arguments.

Instead of grouping all TEs into a few subsets, I aggregated them into the round they were drafted to end that year’s Best Ball Mania. The data was aggregated on a game level, so all games a player played in a year are used. Players with more games are accordingly given higher weights. The replacement value of a tight end often falls around eight points and median replacement points often fall around three points. The graphic indicates how frequently a tight end selected in each round is to break each threshold.

Tight ends from the first few rounds are the most likely to provide major spike weeks. The “elite” tight ends of the past provided much more stability and strong spike weeks than true slate breakers. Very late tight ends show much lower spike week potential. Where the first tight ends go this year, the odds of spike weeks are elevated but no

Prioritizing decent spike week potential holds a meaningful cost early on. Are the smaller spikes with more spray-and-pray options more impactful because of that?

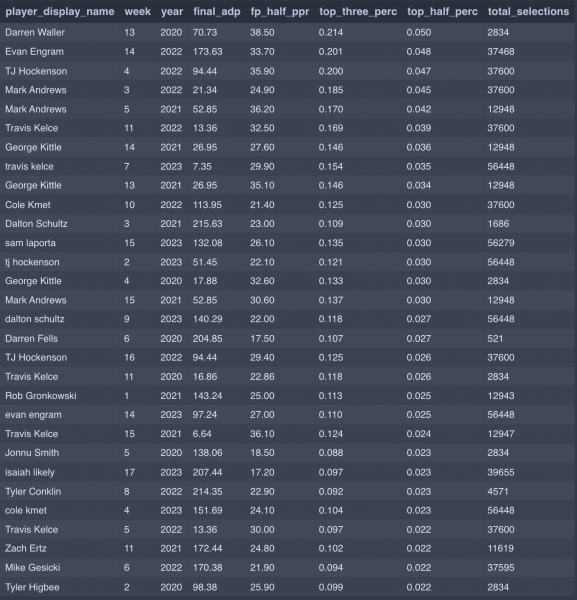

To answer that, I created every team’s weekly lineup for the last four years, found the percentile outcome for the team that week, and then aggregated the lineups to see which performances helped power the most high-end outcomes. There is bias by common pairings and other happenings for the given week, but it should help to illustrate the most impactful weeks we dream of in the fantasy playoffs.

A mix of players and ADPs make up this list of peak performances. There are fewer early tight ends and they carry hefty costs, yet they still make up a considerable portion of this list. Mark Andrews and Travis Kelce appearing on this list for the same year-week is incredibly impressive because each hinders the other’s ability to be this high.

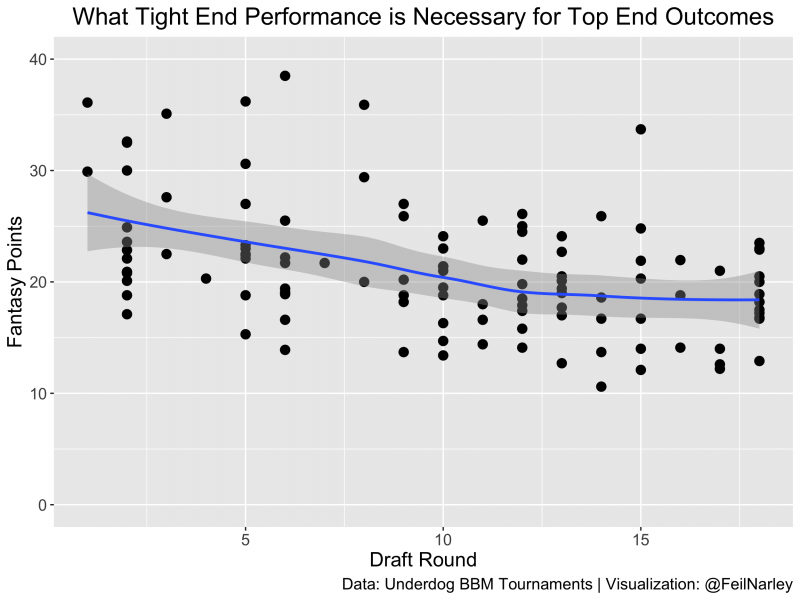

Expanding to look at all performances that increased a 0.5% outcome by more than 2X, we can see what performance differences might be necessary for each cost to shift top-end team performance odds majorly.

There were 118 performances at tight end over the past four seasons which at least doubled the occurrence of top 0.5% outcomes. The difference in score necessary to propel lineups to peak performance for early tight ends does not differ as much from late tight ends as you might think.

There are more late tight ends, and they spike less frequently. To boost lineups’ chances of top-end outcomes, late-round options must score similar amounts to early tight ends. Accordingly, making high-end tight end a priority increases the odds of your teams putting up breakaway performances.

At the same time, the difference in spike weeks from tight ends around round six to those at round 15 is smaller than one might anticipate. While this might be a priority it does not qualify as a necessity.

Comparing Top Tight Ends to the Past

The updating market dynamic influences how we view players and positions. The cost of the same underlying metrics will fluctuate and shift. Some of this is logical, but some of it is illogical. JJ Zacharison recently talked about how when positions see down years they tend to see reduced prices in the upcoming season. Despite this reduced cost, the position typically rebounds and regresses to the previous performance expectation.

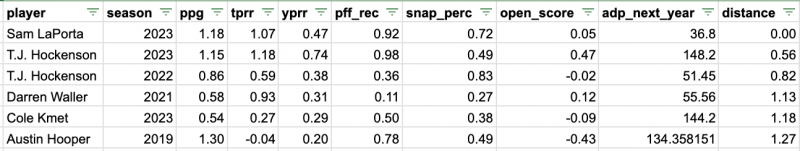

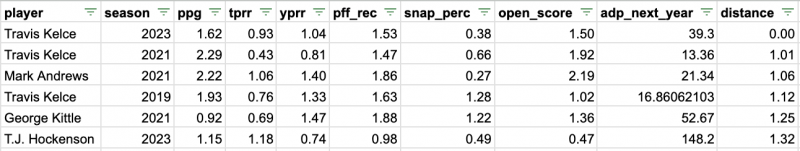

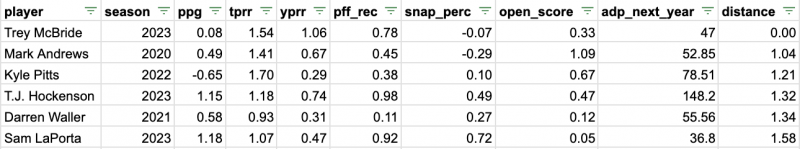

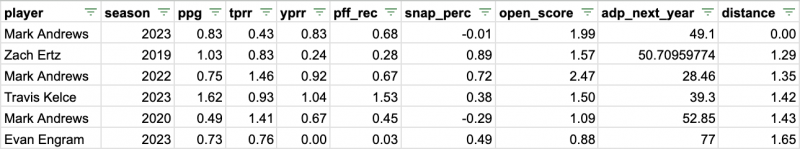

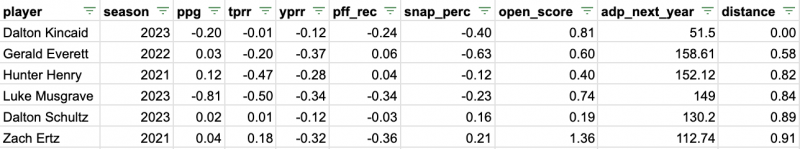

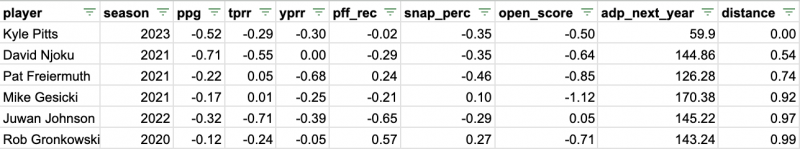

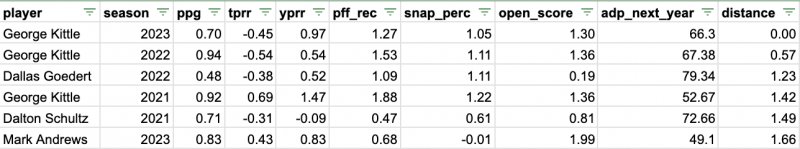

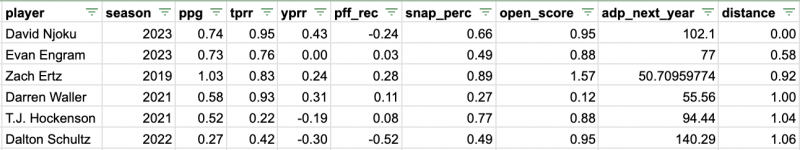

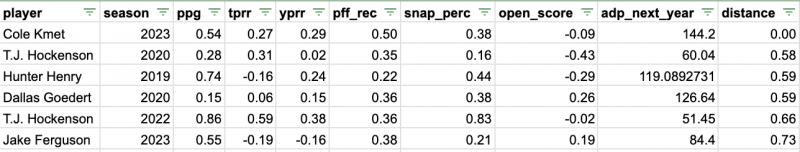

After a down year for elite tight ends, we should expect reduced prices making tight ends better bets at cost. Comparing underlying metrics to historical player seasons should help compare against different draft environments. For this comparison, I took historical data from the season before each BBM, normalized a select set of variables, matched this to the ADP for that year, and calculated the Euclidean distance between points. Below I will show the most comparable player seasons to each TE through round six.

I decided to use fantasy points per game, yards per route run, targets per route run, open score, PFF receiving grade, and regular season snap share. These are commonly cited statistics in the best ball arena. Many of these are correlated so certain attributes are likely being double-counted. Tight ends used for comparison had to have a final ADP in the 16th round or earlier.

Sam LaPorta

In a down year for tight end overall, Sam LaPorta stood out. LaPorta ended the fantasy season as the TE1. Starting as the first tight end off the board makes sense from that perspective, but some of his underlying statistics were not as high-flying as typical elite tight ends.

LaPorta was above average in all metrics utilized here, as evidenced by no negative normalized scores. If T.J. Hockenson had not suffered a devastating injury, he would have served a great price comparison. Other comps are similar but generally scored worse in most metrics. Hockenson’s 2022 and Waller’s 2021 seasons offer reasonable historical justification for LaPorta’s price this year.

On the other hand, having Cole Kmet’s 2023 and Austin Hooper’s 2019 seasons as his next closest comps does not inspire as much confidence. There are mitigating circumstances when looking at those comps. Hooper changed teams and Kmet has significantly more target competition now.

I prefer to see “elite” comparisons, but those are few and far between. LaPorta has fallen to a point where he is priced relatively appropriately. I cannot help but be skeptical of an offense helmed by Jared Goff and the ability to replicate a 10-touchdown season. At the same time, the market expects the Lions to perform again and Ben Johnson is universally seen as a fantastic coordinator. Make your determination on LaPorta, but I’ll continue to be underweight preferring other options at cost.

Travis Kelce

Age continues to come up as the number one reservation for taking Kelce. The age cliff is always looming till it is upon us. Kelce has shown signs of decline, but what else should be expected of someone entering their age 35 season? Even with the decline, part of which could be explained by a nagging injury last season, Kelce still showed strong underlying metrics.

The largest concern was his points per game, this unease should diminish slightly when including the playoffs. Much of Kelce’s down season can be attributed to a poor year offensively for the Chiefs. Last season the Chiefs scored ~6.5 fewer points per game than the previous year. With the team expected to regress to the average points per game of a Mahomes/Reid offense, Kelce should see more end-zone opportunities. There is more competition but that should not be overstated.

Call me a sucker for betting on one of my favorite players but a player with strong efficiency and charting numbers getting an offensive upgrade looks like a desirable player to take going into the next season.

Trey McBride

McBride entered last season as the second tight end on the depth chart. Across the weeks one to four, McBride only drew seven targets and saw 41% of snaps. While this sounds ridiculous now, if Zach Ertz never injured his hamstring, McBride may be more of an afterthought.

Despite having average points per game and regular season snap share, the comps for McBride inspire confidence. Hockenson comes with an asterisk because he could miss most of the season. All other comps went between the third round and the seventh round. In all likelihood, if this analysis looked at yards per game instead of points per game and McBride’s late-season snap percentage, his outlook would only get better.

Toward the end of last season, McBride had a top-five snap percentage regularly. The other difference suggested does have reasoning behind it though. Points per game captures aspects of the environment’s scoring outlook that yards per game misses. Plus, yards per game correlates highly with points per game and other metrics.

The offense should be better in Arizona, but it continues to project below average. Offensive downside already hindered McBride last season, so considering the risk of this happening again before selecting him is a must. McBride's efficiency and underlying stats show a player capable of overcoming a slightly mediocre offense.

The offensive concerns give me pause, but other drafters do not buy into this narrative as much as I do. McBride’s profile makes him someone tough to full fade, but I will also not be significantly overweight at cost. In my estimation, this is also the range where the last reasonably priced wide receivers go for a bit. Pushing up wide receivers and pulling down running backs adjusts the opportunity cost. Taking Christian Kirk, a player in a possible up-and-coming offense, over McBride seems reasonable, but opting for Terry McLaurin, a player with a rookie quarterback on a struggling team, is harder to justify.

Mark Andrews

As with many other high draft picks, finding close comps for Mark Andrews proved difficult. It is encouraging that each of his comps went very early or early for a tight end. Andrews’s 2022 season comes in as his second comp. The direct comparison shows that Andrews was less efficient this past season. Maintaining an open score two standard deviations above the mean is impressive though and suggests he may not have fallen as much as his efficiency suggests. Comparing Andrews’s open score to other tight ends dating back to 2017, his “down” year still marked as the fifth best for a tight end.

Adjustments in the playcalling offer interesting and encouraging updates to Andrews’s true upside. While the offense had typically been considerably below pass rate over expectation (PROE), the first season under Todd Monken ran an offense slightly favoring the pass. The last Ravens offense to have a positive PROE was in 2016.

While efficiency dropped, demonstrating clear skill and operating in a more pass-friendly offense continue to make Andrews an intriguing pick. The comps that went higher than him the next season all had valid reasons, such as more points per game, better efficiency, and more snaps.

There can be understandable reservations about getting Andrews unstacked because he frequently goes with Lamar Jackson. This may marginally impact my ownership, but Andrews will continue to be a buy for me.

Dalton Kincaid

Kincaid is the first sense of pure projection. Only one of the statistics chosen for this analysis favored Kincaid. A couple of primary blockers to Kincaid’s ascendance were his lack of touchdowns and paltry snap percentage. The offense being more bereft of receiver talent than it has been in a while could force Buffalo’s hand. If Kincaid reliably becomes a full-time player seeing 80+% of snaps his price starts to make more sense.

Even considering a bump toward top-end playing time, Kincaid failed to deliver the efficiency and consistency an early TE pick demands. At least Kincaid’s open score suggests a jump in efficiency remains possible.

The comparables that come up for Kincaid are close to his statistical profile with distances under one. Each of his top five comps went in the 100s, some well into the 100s.

Josh Allen and the Bills offer intriguing upside for a tight end, but the first-year performance and comps do not encourage optimism. Tight end continues to be a difficult position to excel at early in one's career. Paying for a player to ascend with limited evidence the jump is coming is a tough position to take. Based on this, I will largely be fading Kincaid unless I have Allen.

Kyle Pitts

The comps for Kyle Pitts were always going to be horrendous. Pitts’s 2023 season came with every possible excuse attached. He was coming off a multi-ligament tear, had bottom-of-the-barrel quarterback play, and played for a coach that insisted on utilizing him sub-optimally, at least from a fantasy football player’s perspective.

While the quarterback and coach have been constant in his career, he does have substantial play sans the impact of a major injury. In Pitts’s two other seasons, he was targeted at a much higher rate, played more efficiently, and charted better for PFF.

Removing all three hurdles for Pitts this season opens the floodgates for his talent to rush out. This may be an over-projection, and it could burn fantasy managers again. Moving to an environment that should enable, rather than hinder him, could make an enormous difference. As a rookie in the dredges of Atlanta Pitts got more than 1,000 receiving yards. Reaching this milestone is difficult for any tight end, never mind a rookie.

In the past, I have not been in on Pitts because of environmental concerns, but I am buying into him stepping up. I will always be a sucker for projections and I fail to see how he projects much differently than wide receivers in his range. While Jayden Reed goes before Pitts, I think the tight end designation makes Pitts a stronger bet to place.

Pitts drives other exposure for me. Considering possible two-vs-twos, I frequently lie on the Pitts side of the equation. Because of this his availability later keeps my earlier tight end exposures in check. While the projection is enormous, he has shown more in the past and the opportunity cost is lower than other tight ends. Going a round later than other picks to this point should not be scoffed at as a small difference.

George Kittle

Finding comps for elite tight ends is difficult because the population is so minuscule. On top of that, while grammatically incorrect, Kittle is a very unique player. The superstar's efficiency year after year while failing to see equivalent targets has become his trademark. Yo-yoing from single-digit games to unmatchable explosions, Kittle offers massive upside but limited floor every week.

Dominating efficiency and charting while posting strong points per game gives Kittle numerous high-end comps. Of course, another of his player seasons is the best possible comparison. Talent like Kittle’s will always be an early to early-ish pick because of the weekly potential he carries. Buying into his upside offers weekly upside with meaningful injury contingency should another skill position player miss time.

Additionally, while unlikely, there is always the possibility that San Francisco leans more into the pass. Purdy has offered stronger quarterback play than past options, so with another off-season of confidence, the coaching staff could adjust tendencies. Making the Super Bowl typically does not lead to one re-evaluating play call tendency too much.

Kittle’s efficiency and upside in the current environment more than justify his price. Considering paths to more fruitful environments through play-calling adjustment or injury makes him a better pick. Of the early group, Kittle marks my third priority buy. He offers proven upside without projection.

Later Tight Ends

Pinpointing tight end breakouts has long been extremely difficult. Anyone saying otherwise better have a stellar track record to back this up. Since last year McBride, Kincaid, Ferguson, and LaPorta have risen dramatically. What characteristics stood out about this bunch at the time? Kincaid and LaPorta were highly touted rookies without an NFL track record. Before last year, few rookies proved themselves immediately at tight end, so this development is encouraging for Brock Bowers.

While age has been a factor recently, there certainly have been later career breakouts at tight end than at other positions. Darren Waller, Logan Thomas, and David Njoku are all examples of players who showed more upside later in their careers.

The best way to succeed at tight end remains spiking on touchdowns. Receiving one pass for a touchdown makes a tight end a reasonable play. Other players who have risen significantly include Robert Tonyan and Dalton Schultz. They both relied heavily on touchdowns to make their ascent. Leaning into offenses that pass and boast strong scoring expectations should yield the best results.

Additionally, showing the potential to play all downs helps significantly. Schultz managed to play just over 80% of the snaps. Being able to block should not be looked down upon, it should be seen as an asset.

Later in drafts, I am open to taking most tight ends. With the reliance on touchdowns, stacking with your quarterback will always be a fantastic option. Below are a couple of interesting mid to later tight ends.

David Njoku

Njoku’s season aligns closely with players with higher costs in the past. They are not just better versions of him across the board too.

The Browns passing game is a slam dunk to buy into this season. They have shown a propensity to pass and play fast. Some believe there to be massive splits with Joe Flacco playing, but this is likely true under Watson. Undeniably he played fast last season. Plus Steffanski has shown a desire to pass. This is only bolstered by the hiring of Ken Dorsey as offensive coordinator. He managed a pass-first attack in Buffalo before being scapegoated for poor team performance last season.

Njoku was already a great bet for numerous reasons, but these comps only instill more faith in that belief.

Cole Kmet

The offense in Chicago should see major changes. New faces in the passing game will likely reduce Kmet’s percentage of the target share. However, Kmet was relatively efficient with one of the league’s worst passers. Kmet’s potential to consolidate snaps makes him an interesting option. Previously, Kmet was an afterthought for me, but seeing an offensive upgrade and quarterback upgrade should give him better opportunities, even if they are less frequent.

The comparisons for Kmet all went well before his cost this year. With Chicago projecting to be an average offense and possessing a wide range of outcomes, Kmet looks like a meaningful buy. His track record won’t blow anyone away, but it is better than it may appear at first glance.

Wrap Up

Tight end may be deeper at the top than it used to be, but the top options do not measure up to years past. Applying the “elite” title and statistics to top options this year could throw off analysis, but there are still good bets at cost. Kincaid and Pitts in particular are almost entirely projections. The price could be justified but the past play is not entirely why they are drafted where they are. Where you buy into the forecasts or see things differently should dictate how you play the position.

Early tight ends offer the best upside to propel teams, but these picks come with an opportunity cost. Players are generally appropriately priced. Even if you take an early tight end, ending with three is always a good option. Later on, look for upside in good offenses. Touchdowns make or break most tight end plays, so lean into healthy offensive environments.

I considered other possible frameworks to compare prices to the past. Each option possessed shortcomings. Exact statistical comps are few and far between as we constantly deal with small datasets. Other pre-round 17 tight ends that offer offensive upside or projection upside include Jonnu Smith, Tyler Conklin, and Noah Fant.